EasyPaisa is a mobile wallet account in Pakistan. This is one of the most used and popular wallet accounts used for transactions across Pakistan, and you can also make transactions to other countries through this mobile account.

Telenor network can make transactions and accounts on this, and other network users can create their accounts to avail of EasyPaisa services.

If you need urgent cash but don’t have it, or if your account credit is going to end soon and you need to do urgent transactions, you can also get a loan from your Easypaisa account. The amount you borrow from the EasyPaisa account will be immediately transferred to your account, and you can use it.

If you don’t know how to apply for a loan and how to get a loan from the EasyPaisa app, then here I will tell you about the complete method.

Table of Contents

How to Get an EasyCash Loan from the Easypaisa App? Step-by-Step Guide!

Here, we will discuss the complete method to get a loan from the EasyPaisa app. Follow the easy instructions to get a loan successfully.

- Install the EasyPaisa app from the Google Play Store. The app is compatible with Android and iPhone.

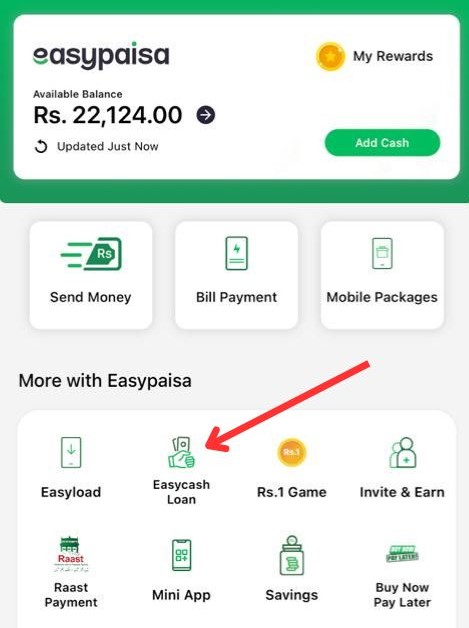

- Now, navigate the home menu and search for the tab “Easy Cash Loan.”

- Now, choose your status, married or single, and provide the details of your spouse, like name and occupation, etc.

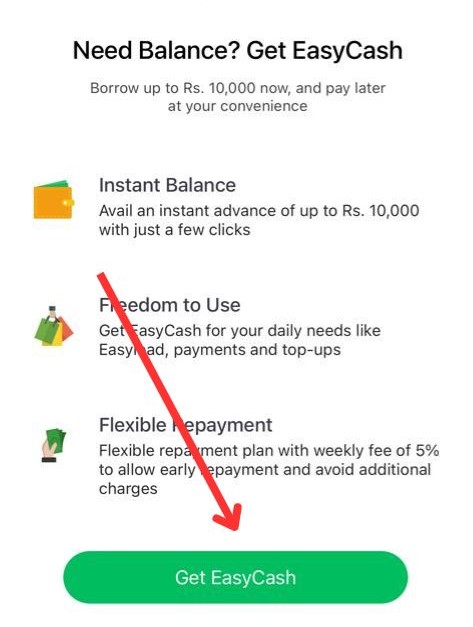

- After that, choose the amount that you want to get a loan. Tab on the next button.

- Review the cash details and press the “Get Easy Cash” tab on the screen.

Using an app is an easy method for getting a loan from EasyPaisa.

Requirements to Get Instant Loan from the Easypaisa App

To get an instant loan from the Easypaisa app, you can follow these steps:

- Install the Easypaisa app on your smartphone and sign up for an account.

- Complete your Easypaisa mobile account registration by providing the required information, such as your CNIC number and other personal details.

- Once your account is activated, tap the “Loans” icon on the app’s home screen.

- Choose the loan amount and the repayment period you want.

- Provide the required information and documents, such as your employment and bank account information.

- Once you submit the loan application, the Easypaisa team will review and process it.

- If your application is approved, the loan amount will be instantly transferred to your Easypaisa mobile account or your linked bank account.

It’s important to note that loan eligibility requirements may vary depending on the lender and loan type. Also, before applying for a loan, it’s crucial to read and understand the terms and conditions of the loan to avoid any surprises later on.

Can I Get an EasyPaisa Loan from Another Network?

You can create an EasyPaisa account on other networks like ZONG, Ufone, and JAZZ. You can get a loan even if you are another network user. But you cannot get a loan for other networks by using the EasyPaisa code. But you can easily get a loan using the app mentioned above.

What are the requirements to get a loan?

EasyPaisa can provide you with a loan, and you can get the loan by simply dialing an EasyPaisa account code or using the app. However, there are specific requirements and limitations. The loan is only transferred, and you can only apply for it if your account’s 90 days’ usage is in better condition and fulfills the terms and conditions of the account balance.

Frequently Asked Questions

You can get an EasyPaisa loan or a personal loan for seven, fourteen, and thirty days. The tax will be applied respectfully, and if the loan is not paid within 30 days, the extra charges will be applied, which will be 5% extra.

Yes, the other network users can also get an EasyPaisa loan if they need it. They can apply for the loan through the EasyPaisa app, but they do not get loans through code.

The normal limit of EasyPaisa loans is from 200 to 10000. However, the level of your account matters. If you upgraded your account, you can apply for a 50k cash loan, but there are specific terms and conditions. Your age must be 21 to 57, and you have at least more than 13 thousand monthly income.

The time it takes to get a loan from EasyPaisa may vary depending on the lender and the type of loan. However, generally, you can get a loan instantly or within a few hours of submitting your loan application.

You can repay your EasyPaisa loan through your Easypaisa mobile or linked bank accounts. You can repay your loan through the EasyPaisa app or by visiting an EasyPaisa agent.

Final Summary

EasyPaisa wallet account is widely used in Pakistan for making everyday transactions. You can use the EasyPaisa app and navigate the account through code *786#.

This article will help you get a loan from an EasyPaisa account by using the EasyPaisa app. You can also get a loan by code if you don’t have an app or internet connection. However, the other network users can get the loan only by using the app. I hope this article will be helpful for you. Thanks for visiting.